“WHAT? There Is No Such Thing as Dental Insurance?!!!” A 3-part Series

I love the response I get when I ask a patient this question: “Are you aware there is no such thing as dental insurance?”

The patient inevitably answers my question with a question, “What do you mean there is no such thing as dental insurance… what am I paying for?!”

In this 3-part series, “WHAT? There is No Such Thing as Dental Insurance?”, we will explore key components of dental benefits that can be used to develop educational team and patient communications.

- The Difference Between Insurance & Dental Benefits

- Two Lessons Every Dentist & Practice Administrator Needs to Know About PPO Dental Benefit Contracts

- Attract & Retain Your Patients via Membership Plans

Part 1 – The Difference Between Insurance & Dental Benefits

When a patient asks me the question, “What am I paying for?” my response is, “I’m so glad you asked!”

Merriam-Webster’s Dictionary defines insurance as:

- Coverage by contract whereby one party undertakes to indemnify or guarantee another against loss by a specified contingency or peril.

- A means of guaranteeing protection or safety.

A traditional medical insurance policy ensures that you are protected financially if you experience a medical catastrophe. Once you reach your deductible, the insurance plan pays a certain percentage (%), and you pay a certain %, up to your out-of-pocket maximum for the calendar or plan year. Once your plan reaches a pre-defined out-of-pocket maximum, your insurance company pays 100% of your medical expenses.

For example, if you have a fire that burns your house down and you have a homeowner’s insurance policy, the insurance company will rebuild your home after you pay your deductible with no additional cost to you.

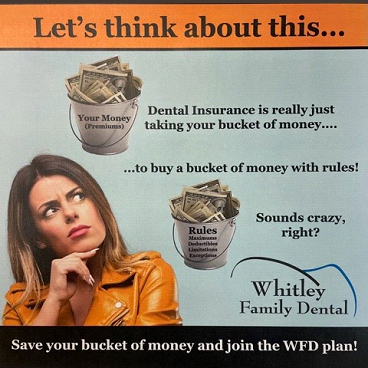

Dental insurance fits neither one of Merriam-Webster’s insurance definitions. If dental insurance is not insurance, then what is it? Dental “insurance” is dental benefits. As the graphic suggests, dental benefits are quite simply taking a bucket of money called “premiums” to buy a bucket of money with rules!

The dental benefits lobby has convinced society that dental benefits policies are insurance, and if you are going to be able to receive affordable dental care, you better have one of these “insurance” policies in place. One of the ways the lobby has accomplished this misrepresentation is by using some of the exact terms and acronyms for medical insurance. For example, premiums, deductibles, PPOs, and maximums.

When explaining the difference between dental “insurance” and dental benefits to our team and our patients, we use the term MAXIMUM to illustrate our point. When you reach your medical out-of-pocket maximum, the insurance company that holds your policy pays 100% of your medical expenses. When you reach your dental annual maximum – when you run out of the bucket of money that you bought – you pay 100% of the dentist’s full fee for all services over and beyond the annual maximum.

It is important to educate your team and your patients about the differences between insurance and dental benefits. It is also important to give them visual examples of the difference.

The best tool we have found in educating our team and our patients about the difference is the patient’s eligibility and benefits report, which has their name at the top of the report. This report is also known as the rules for the bucket of money they have bought.

We ask patients if they know the detail of their benefits. Almost 100% of the time, they say, “We get 2 free cleanings.” At that point, we SHOW them the rules of their free cleanings on their own eligibility and benefits report:

- We show them their annual maximum.

- We show them if their deductible applies to their free cleanings.

- We show them if the total cost of their free cleanings counts toward their annual maximum bucket of money.

- We show them their frequency limits on basic services like cleanings, X-rays, and exams.

- We explain downgrades using the example of a patient who wants a tooth-colored filling, but their benefits policy only covers silver fillings. This is an example of where the difference in cost is passed on to the patient.

After reviewing the patient’s information, the next question they have is, “Is it worth it to have a dental plan?”

We’ll delve into this question and how to answer it next week in part two of this three-part series!

- Dental Insurance Part 2 – PPO Dental Benefit Contracts

- Dental Insurance Part 3 – Attract & Retain Your Patients via Membership Plans

About the Author

Tamara Whitley, MAADOM, is the co-owner and practice administrator with Whitley Family Dental in Dallas, Texas. Tamara brings over 30 years of proven business and insurance administration experience to her role from such notable companies as Cigna, CVS, ADP, and Medco Health Solutions.

When Tamara found AADOM, she went “all in” with a lifetime membership. Tamara is a member of her local AADOM Dallas/Ft. Worth, Boston, Metro Detroit, Southern Maine, and Dental Spouse Business Network (DSBN) chapters. Tamara was inducted as an AADOM Fellow (FAADOM) in 2021 and earned her AADOM Mastership (MAADOM) in 2022. She is on track to be inducted as an AADOM Diplomate (DAADOM) in 2023.

Tamara holds a Black Belt in Six Sigma Process Methodology, as well as her OSAP-DALE Foundation Dental Infection Prevention & Control Certification.

She has been married to Dr. Bill for 33 years. They enjoy traveling with their son, reading, and cooking.