“WHAT? There Is No Such Thing as Dental Insurance?!!!” – Part 3

Attract & Retain Your Patients via Membership Plans

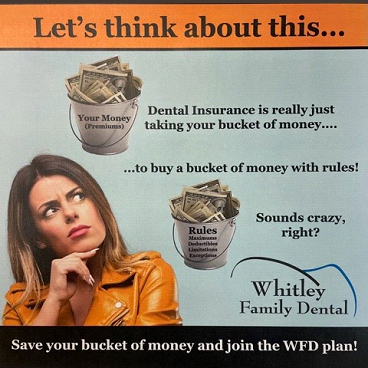

In Part 1, The Difference Between Insurance & Dental Benefits, we learned how to communicate the difference between insurance and dental benefits. Dental benefits are quite simply taking a bucket of money, called premiums, to buy a bucket of money with rules.

In Part 2, Two Lessons Every Dentist & Practice Administrator Needs to Know About PPO Dental Benefit Contracts, we learned that every dentist and practice administrator need to be aware of 1) Reviewing ALL PPO contract fees and 2) Knowing your break-even number prior to negotiating and executing the PPO dental benefits contracts.

In Part 3, we will discuss implementing a Dental Membership Plan as an option to retain your patients if you exit a PPO plan, as well as being a great way to attract new patients. We will also answer the question we raised in Part 1 – is it worth it to have a dental benefits plan?

Key Considerations for Moving Out-of-Network (OON)

- Communication Strategy – So you’ve done the math and realized that the PPO contract(s) the doctor signed has the dental practice in an upside-down contract…meaning the reimbursement from the dental benefits company is below your break-even cost to keep your doors open. Once the decision to move OON has been made, a comprehensive team and patient communication strategy is needed to answer these critical questions:

- Why is this change necessary?

- When is this change happening?

- What is changing?

- What is NOT changing?

- What options do you offer to keep your patients?

We have found that face-to-face, educational, and transparent conversations work best at least 6-8 months from the exit effective date. This timeline also allows most patients the opportunity to make an informed decision prior to their open enrollment period.

- Assignment of Benefits – AOB is the ability of the patient to give permission to the dental benefits company to pay the provider for dental services. It is important to educate your team and patients that the details of the direct contract between the employer and the dental benefits company define the AOB rules. Does the contract say the provider gets paid? Or does the employer contract say that AOB is restricted for OON providers – meaning the dental benefits company pays the patient directly?

- Options to Retain Patients When Exiting PPO Networks – Through the dental benefits companies, several employers reimburse the provider’s full fee for preventative services. For those employers whose contract allows capped fees to the providers and balance billing to the patients, providing a Dental Membership Plan is a great alternative to retain your patients as you move OON.

Making Membership Plans Enticing for Patients

Prior to developing a Dental Membership Plan, we asked our patients what would make a dental membership plan valuable to them. We were then able to create the best plan for our patients to maximize enrollment in our plan.

- Know your patient demographics (e.g., multi-generational, mainly military if near a base, blue collar vs. white collar, near a college campus dominated by students, etc.).

- Know your practice financials (e.g., break-even cost per hour we defined in Part 2 of this series, and share that number with the patient).

- Know what type of Dental Membership Plan fits your patient demographics for the dental practice (e.g., either 1. A pre-paid Preventative Plan with an overall percent-based fee reduction on other services, or 2. A pay-as-you-go [ala carte] plan that reduces fees for all services offered in the dental practice).

During the face-to-face patient conversations, we share the dental benefits company reimbursement rate from their previous EOBs. We also share our per-hour break-even cost to provide dental services to the patient.

They realize we can’t keep our doors open if we don’t meet our break-even point.

We then ask them how much comes out of their paycheck for their dental benefits. Their response is always, “Oh, it’s cheap compared to medical insurance. It’s like $25.00.” I then say, “GREAT…how often do you get paid?” And they answer, “Every other week,” which works out to be $650.00 per year the patient is paying for the right to open my door before they spend a dime on treatment.

They are appalled that their two “free” cleanings cost them $325.00 per cleaning. Most of our patients’ plans allow $1,500.00 per year, per dependent, so the patient only receives $850.00 in benefits after paying premiums of $650.00!

We kept these numbers in mind when we developed our membership plan. We purposefully came in under the $650.00 premium cost, making moving to our membership plan a “no-brainer” for the patient.

I, for one, would much rather reroute my dental benefits premiums to pay for actual dental services that I receive instead of pre-paying for benefits I may never need. And I certainly do not want to pay $325.00 for cleaning if I experience no additional issues.

“Is it worth it to have a dental benefits plan?” Well, it depends on:

- How much the patient is paying in premiums

- If the employer’s contracts allow capped fees and balanced billing

- The many rules that apply to the patient’s bucket of money, such as deductibles, frequency limits, plan maximums, and downgrades

- If AOB is restricted

- If the employer subsidizes more of the total plan cost for the patient

Sitting down with patients and helping them to do the math will give them the ultimate answer to the question of “Is it worth it to have a dental benefits plan?”

We are quick to educate the patient that if it makes more financial sense for them to stay on their dental benefits plan, then by all means, stay on that plan.

For example, we have a patient whose employer heavily subsidizes the cost of his plan, and the plan pays us our full fee. As such, it would cost him more to be on our membership plan.

Help the patient do the math and let them choose what is best for them and their family!

REMEMBER: Educate the patient that they must choose between the dental benefits plan OR your membership plan. They can’t have both.

The Takeaway

Patient education, communication, and transparency about their dental benefits bucket-of-money is hard work, but when patients realize that you are their advocate, it creates a beautiful partnership between the doctor, the dental team, and the patient.

An old dentist proverb goes, “Patients don’t care how much you know, until they know how much you care.”

Educating your patients about where their money is being spent on their oral health shows them that you care.

So, what happens when you take good care of your patients and their bucket of money? Your bucket of money will increase as well!

- Dental Insurance Part 1 – Difference Between Insurance & Dental Benefits

- Dental Insurance Part 2 – PPO Dental Benefit Contracts

About the Author

Tamara Whitley, MAADOM, is the co-owner and practice administrator with Whitley Family Dental in Dallas, Texas. Tamara brings over 30 years of proven business and insurance administration experience to her role from such notable companies as Cigna, CVS, ADP, and Medco Health Solutions.

When Tamara found AADOM, she went “all in” with a lifetime membership. Tamara is a member of her local AADOM Dallas/Ft. Worth, Boston, Metro Detroit, Southern Maine, and Dental Spouse Business Network (DSBN) chapters. Tamara was inducted as an AADOM Fellow (FAADOM) in 2021 and earned her AADOM Mastership (MAADOM) in 2022. She is on track to be inducted as an AADOM Diplomate (DAADOM) in 2023.

Tamara holds a Black Belt in Six Sigma Process Methodology, as well as her OSAP-DALE Foundation Dental Infection Prevention & Control Certification.

She has been married to Dr. Bill for 33 years. They enjoy traveling with their son, reading, and cooking.