“RCM – The New HOT TOPIC For Office Managers”

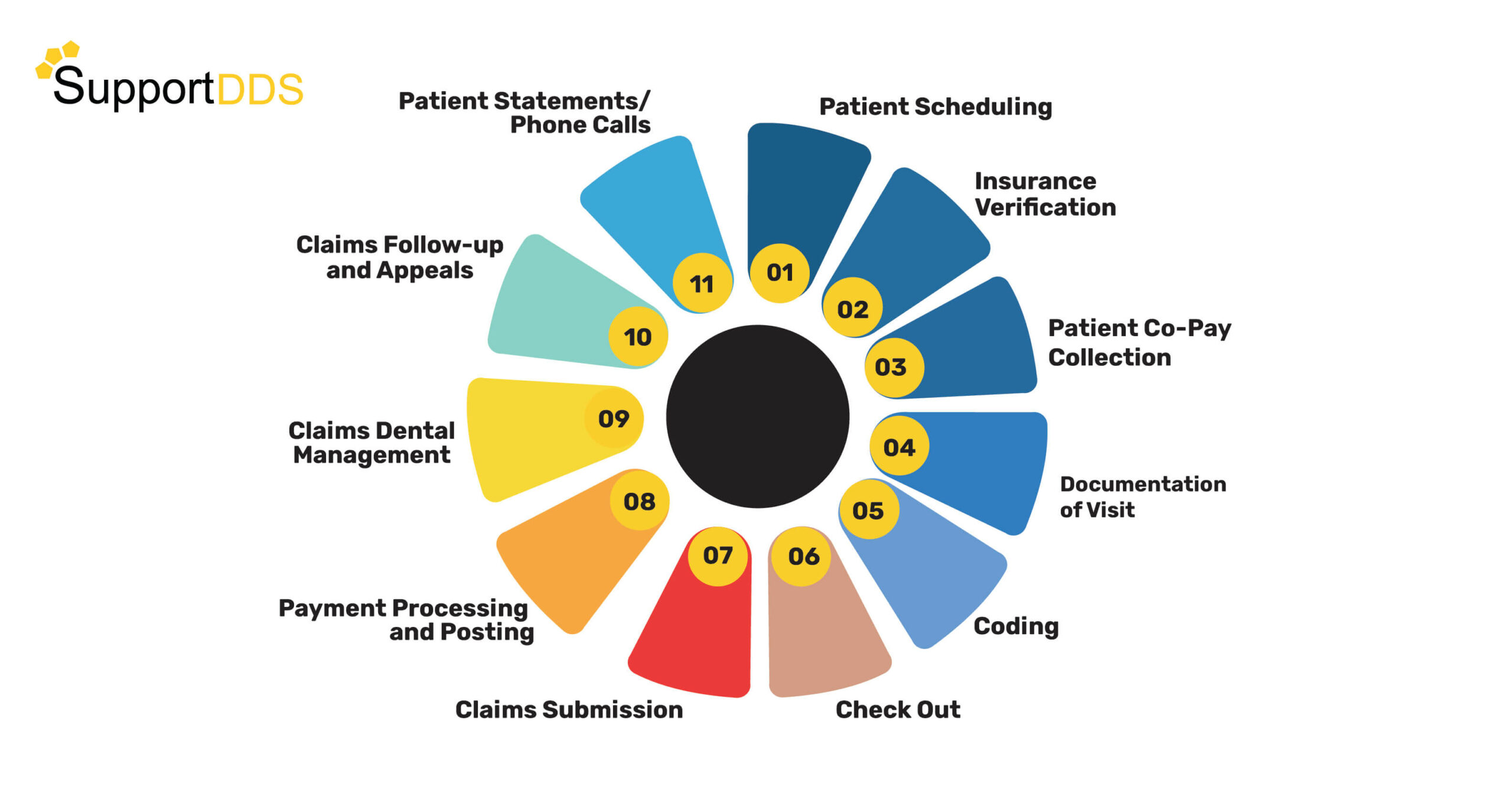

Revenue Cycle Management…Click to open this link in a new tab… (RCM) helps you improve your collections process and ensures you account for every cent your dental business generates and deserves. It is the period from when you schedule a patient appointment to when you receive the final payment for the treatment provided.

Not having healthy revenue cycle processes, SOPs, and procedures in place comes with a host of potential problems, some of which can have far-reaching implications for the success of your practice. Here, we identify and examine some of the most common challenges throughout the various stages of RCM…Click to open this link in a new tab… that we have seen, and share our top solutions to solve them.

What are the common RCM…Click to open this link in a new tab… issues that affect a dental practice?

1 – Lack of insurance verification

Insurance verification is the first phase and is an essential step in the dental billing process and will help you avoid surprises for both the patient and the practice.

Suppose a practice does not verify a patient’s insurance coverage before seeing or treating the patient. In that case, it can lead to claim denials, write-offs, subpar office collections, and poor patient satisfaction.

2 – Not submitting claims daily

No matter how busy you get, submitting your claims and supporting documentation every day with a systematic approach is important. This will help ensure that claims are processed promptly, and revenue is paid on time.

There are several consequences of not submitting claims daily. These include:

- Delayed payments. Insurance companies have deadlines for submitting claims. If you miss the deadline, your claim may be denied or delayed. You will likely have to wait longer to receive payment, negatively impacting your collections.

- Increased workload. If you delay submitting claims, you will have a large backlog of claims needing to be submitted and processed. This will increase your workload and make it difficult to keep track of claim status.

- Increased errors. When you submit claims late, there is a greater risk of mistakes. This can lead to denied or delayed claims, which can further impact your collections.

3 – Poor follow-up processes

Without adequate insurance and patient A/R follow-up processes, more patients will “escape” with unpaid balances.

Insurance A/R: If claims are not timely and properly followed up on, there is a risk that the office will not catch that claims are being denied. If not sent in time, this can lead to financial losses for the practice.

There are several reasons why claims may be denied or delayed, such as incorrect coding, no coding, or missing information. You can identify and resolve these issues by implementing a claims follow-up process that ensures prompt review.

Patient A/R: When you collect patient A/R immediately, you increase cash flow and create a healthy collection rate. This is essential in a thriving practice.

Bad debt occurs when you cannot collect payment for the treatment you have provided. A system to manage patient A/R can reduce the risk of bad debt write-offs.

4 – Not enough time

RCM…Click to open this link in a new tab… becomes a heavy burden on practices with insufficient resources (teams) allocated adequately for the following:

- Insurance verification

- Check-in / Check-out

- Responding to phone calls (inbound and outbound)

- Doctor and hygiene schedules

- Recall/Recare

- Insurance claims submission and follow-up

- Payment posting

- Managing accounts receivable

- And, more importantly, providing 5-star customer service and patient care!

Managing and overseeing these tasks and doing them well with less than sufficient resources is nearly impossible.

Solutions to common RCM…Click to open this link in a new tab… issues

Leverage technology and remote team members…Click to open this link in a new tab…

Invest in technology. Many new and exciting AI-driven RCM solution platforms are on the market today. They are constantly improving and making the process smoother, quicker, and more efficient. Invest in these solutions and utilize virtual/remote team members to fill the gaps.

Every year, a significant amount of revenue is lost from unverified insurance and a lack of A/R follow-up processes. With a virtual remote team from SupportDDS…Click to open this link in a new tab… complimenting your RCM…Click to open this link in a new tab… software solutions, you can get complete insurance breakdowns, daily claims submission, and follow up on claims and patient A/R more quickly than you do today. This rapid turnaround time makes it possible for you to reduce A/R and receive your payments in a timely manner.

Virtual assistants save time, elevate your team

The idea of having success with virtual team members might seem far-fetched. Still, when you invest in remote team members and complement them with your “in-office” team, you lessen your workload without compromising the quality of patient care. This process allows you to “elevate” your office team to provide 5-star care to your guests/patients!

In summary, when you spread out the workload, you get;

- More expertise in your practice

- Boost your collections

- Increased revenue

- Elimination of billing errors

- Reduce overhead costs

- Gain the ability to focus on your patients solely

In Summary

With improved RCM…Click to open this link in a new tab… processes in place, you will discover enhanced accuracy in your administrative tasks, resulting in increased office collections. Additionally, you can sustain long-lasting, trusting relationships with your guests/patients.

About the Author

Victoria Johnson

Victoria Johnson is the chief growth officer of RCM Solutions for SupportDDS. With more than a decade of experience, she has served in progressive leadership roles in dental practices and DSOs, specializing in strategy, optimization, and implementation of the entire revenue cycle operation.