“WHAT? There Is No Such Thing as Dental Insurance?!!!” – Part 2

Two Lessons Every Dentist & Practice Administrator Needs to Know About PPO Dental Benefit Contracts

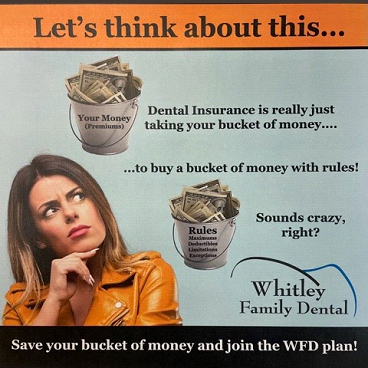

In Part 1, The Difference Between Insurance & Dental Benefits, we learned how to communicate the difference between insurance and dental benefits. Dental benefits are quite simply taking a bucket of money, called premiums, to buy a bucket of money with rules.

Now we will explore two lessons every dentist and practice administrator needs to be aware of prior to entering into a PPO dental benefits contract, but before we begin that exploration, I need to take you back in time.

The month was August. The year was 2009. This was the year my husband, the dentist, moved from being an associate of 13 years to owning his own practice. He was unable to bring his patient base with him, so we treated the practice as a start-up. We knew that if we were going to get patients in the chair, we would need a marketing strategy that included building a website, sending out mailers to targeted zip codes, and signing up with PPO dental benefits companies. The PPO agreement was that we would lower our fees, and the PPO companies would send us new patients. We knew that in 6 months, we would be able to turn a profit… WOW… WERE WE WRONG!

It would be 9 years before Bill would bring home a paycheck! Let that sink in… 9 YEARS before the dentist would bring home a paycheck!

He earned more as an associate than he did as the practice owner…and we didn’t know why. We came up with lots of excuses for why this was happening. We bought and built too fancy of a practice. He didn’t perform certain procedures like root canals, extractions, or oral surgery. He was conservative in treatment and would try a composite before moving to a more expensive procedure like a crown. Excuses, excuses, excuses!

During his dental school years, I would often fantasize about us working together. When I finally verbalized my fantasy, Bill’s exact words were, “Over my dead body will you ever work in my office.” I gave up on the dream of working together and built my own career, ultimately ending up as the Vice President of Client Operations for Fortune 500 companies: Medco Health Solutions, Cigna, CVS, and ADP. I would shovel my salary, bonus, and stock options to fund the dental office payroll and overhead costs.

Fast forward to the summer of 2017 when we were notified that my VP of HR & Benefits job with ADP would move from Dallas to El Paso. While I was under my non-compete agreement and living on severance pay, Bill had finally had enough. He asked me to TEMPORARILY come to the office and use my 27 years of benefits and insurance experience to figure out why he was more profitable as an associate than he was as an owner.

I quickly discovered 2 MAJOR issues:

- 504 claims over 500 days old aging (which is another article for another day), and

- We had 34 separate dental benefits fee schedules

As I began the 10+ month effort to clean up the aging claims, input reimbursements, and fight for payment from the dental benefits companies, I noticed names of companies that I had never heard of in dental benefits. Bill told me that he never signed a PPO contract with these companies, so I was at a loss as to why we were under contracts that we never signed. The more I loaded the EOBs, the more I realized we were underwater on ALL of the reimbursements/contracts with these companies…meaning the amount we were being reimbursed wasn’t enough to cover our break-even hourly cost to provide dental services.

After the aging claims exercise, I was able to get Bill his first paycheck in August 2018, albeit a very small one. Our trouble was FAR from over. Even with 27 years of working for insurance and benefits companies and uncovering the real issue preventing Bill from receiving a paycheck, I had no clue how to start unraveling 34 fee schedules. I went to a trusted advisor in the dental industry and told him of my discovery. After hearing me say, “I don’t know how to “undo” this nightmare,” he pointed me to Craig Dreiling at Solutions 101.

S101 analyzed, clarified, and developed a CUSTOM strategic plan for our office using our own practice data contained in our EOBs. The S101 team is a re-engineering team consisting of Ph. D.s, attorneys, and business owners that perform a deep, analytical process that educates its clients on how the PPO Contracts will perform against their own data, which networks to keep, which networks to exit, how to exit leased networks (34 fee schedules was really 52 with networks for some companies I had never heard of), how to accurately set fees, how to communicate with patients regarding their dental benefits, and the order in which the practice should execute the strategy to maximize patient retention.

S101 is not a PPO fee negotiating or dental consulting company. They do NOT sign non-disclosure agreements with the insurance companies because if they signed the NDA, that would prevent them from disclosing the fee structure to YOU – their client. I don’t know about you, but if I am going to hire someone to help me wake up from the PPO nightmare, I expect EVERYTHING to be disclosed to me so I can make educated and informed decisions.

S101 is a project-based firm that helps you make sense of the PPO web and discloses exactly how the PPO contract will perform for each company. Because of S101, I have now become a black widow spider that attacks the PPO web and my insurance prey, which in turn, allows Bill to bring home a bigger paycheck.

What are two lessons every dentist and practice administrator need to know about dental benefits PPO contracts? 1) WARNING When Negotiating PPO Fees, and 2) Hourly Cost to Do Business.

WARNING When Negotiating PPO Fees:

When entering fee negotiations, dental benefits companies use a tactic that is permitted based on the contract language. It is the old bait and switch…look over there while we do this over here!

Dental benefits companies will slightly raise the fee on more frequently used codes while simultaneously lowering the fee on more expensive procedures.

For Example: Prophy – D1110 is raised by $5.00 while a PFM Crown – D2750 is lowered by $50.00.

The dental benefits company gives you a small victory in the prophy increase and hopes that you won’t notice the lowered crown fee. Again, all of this is outlined as permissible in the PPO contract, but unfortunately, the dentist signing the contract does not receive this type of education in dental school. It is so important for practice administrators to help educate the dentist prior to signing any PPO negotiated contracts.

LESSON LEARNED: Review ALL fees before signing the initial contract, as well as prior to accepting any newly negotiated rates

Hourly Cost to Do Business:

Here is a common conversation I have had with other practice administrators:

Practice Administrator: This fee schedule is good.

Me: How do you know?

Practice Administrator: I have been told it is good.

Me: What is considered good?

Practice Administrator: Fees are higher than they used to be.

Me: Is that good enough?

What is considered good for one dental practice may not be so good for another.

If the PPO reimbursement falls below your break-even point to run your practice, then DON’T SIGN THE CONTRACT! Figuring out your break-even point per hour to run your practice is not hard. You do not need to know adjusted production, rate of adjustment write-offs, % of collections, etc. You simply calculate the total expense for the year – INCLUDE EVERYTHING – yes, including the dentist’s salary.

The Simple Equation:

- TOTAL expenses for the year found on the P&L (Profit & Loss Statement) – rent, mortgage, utilities, payroll including dentist’s salary, taxes, supplies, instruments, maintenance, office supplies, medical & life insurance, postage… EVERYTHING!

- Divide the total expenses for the year by the number of hours the dental office works

- Divide the per-hour cost to run your business by the number of operatories you have, and voilà – you have your per-hour per chair cost to keep your doors open

Example Using Equation:

- The P&L expense line for the year = $780,000.00

- Divide $780,000.00 by the hours worked in a year. The office works 4 days per week, so that equals 1664 hours per year

- The per-hour cost to run the practice in this example is $468.75 to break even. You must make this number per hour to keep your doors open

- Divide your per-hour cost by the number of operatories you have – this is your per-hour cost that each chair must meet to reach the practice per-hour goal of $468.75 = $117.19

I understand that many practice administrators may not have access to the profit & loss statement for the practice. If you do not have access to the P&L, show this article to your dentist and have them give you the total expense line.

Once you know the expense number, you can easily calculate your per hour per chair cost. We will use this number in next week’s wrap up to this 3-part series – Retain Your Patients via Membership Plans.

LESSON LEARNED: Know your practice numbers…especially your break-even point to keep your doors open

As for the dentist that said, “Over my dead body will you ever work in my office”? He has become the dentist who now says, “Over my dead body will you ever leave my office”

- Dental Insurance Part 1 – Difference Between Insurance & Dental Benefits

- Dental Insurance Part 3 – Attract & Retain Your Patients via Membership Plans

About the Author

Tamara Whitley, MAADOM, is the co-owner and practice administrator with Whitley Family Dental in Dallas, Texas. Tamara brings over 30 years of proven business and insurance administration experience to her role from such notable companies as Cigna, CVS, ADP, and Medco Health Solutions.

When Tamara found AADOM, she went “all in” with a lifetime membership. Tamara is a member of her local AADOM Dallas/Ft. Worth, Boston, Metro Detroit, Southern Maine, and Dental Spouse Business Network (DSBN) chapters. Tamara was inducted as an AADOM Fellow (FAADOM) in 2021 and earned her AADOM Mastership (MAADOM) in 2022. She is on track to be inducted as an AADOM Diplomate (DAADOM) in 2023.

Tamara holds a Black Belt in Six Sigma Process Methodology, as well as her OSAP-DALE Foundation Dental Infection Prevention & Control Certification.

She has been married to Dr. Bill for 33 years. They enjoy traveling with their son, reading, and cooking.